Addressable Anxiety? Time to Jump In

“Crossing the chasm” and what is it going to take for advertisers, programmers and distributors to adopt and accelerate addressable? What is holding it back? What are the myths out there?

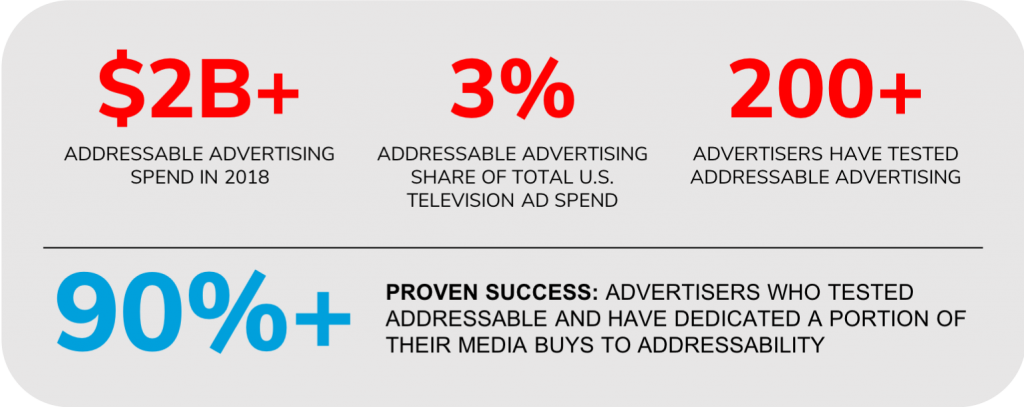

Two billion dollars. Or actually, more than two billion dollars. That’s about how much money advertisers will place on addressable television in 2018, from a standing start just a few years ago. Sounds great, right? I mean, if you started a business that was doing a couple of billion dollars you’d be thrilled. I sure would be. But compare two billion to the roughly seventy billion that advertisers spend on American television and suddenly it doesn’t seem like much – not even three percent.

And yet over two hundred advertisers have tested addressable television, and their tests have proven successful enough that over ninety percent of them have dedicated a portion of their media buys to addressability. One rarely sees a success rate more than ninety percent anywhere, much less in advertising.

Which raises the obvious question: How can a technology that is demonstrably so effective have such a low share of television spend? What’s holding it back?

Based on many conversations with media people as well as marketers, I can point to four main reasons:

1. Distributor Reach

While addressable television was planned from the outset to be a universal improvement to “conventional” television advertising, the rate of adoption by distributors (i.e., cable, telco, satellite) has varied. And while there are many advertisers who have successfully tested addressable campaigns covering less than a full national footprint, there are others who have used that as an excuse to hold back. In our opinion that’s a very big missed opportunity to establish solid learning about addressable practices, learning which will become increasingly valuable as the footprint expands to universality. But all we can do is lead a horse to water.

2. National Network Addressability

As with universal distribution, it has been the long-term vision to extend addressability to all forms of television: The distributor inventory (i.e., the “local two minutes”) as well as networks (broadcast and cable) and local television. But so far addressability is limited to distributor-controlled inventory; some advertisers are waiting on the sidelines until the others are lit up.

3. Clear Attribution Analyses

Television advertising historically has been an effective but blunt instrument. ROI analyses, such as they are, fall into the hand-waving category: “We spent X on television and our market share increased by Y.” Addressable television brings with it a much more precise way of determining who saw the spot and how they responded. But as with all new forms of analysis, this one brings skepticism on the part of advertisers and media buyers; it’ll take a while for them to see just how reliable this form of attribution analysis really is.

4. Advertiser Timidity

Advertising has historically been a business made up of a few daring explorers and a whole bunch of timid followers. And those followers really don’t act until they believe the path has been cleared of all danger. Even though there’s a great deal of evidence showing that addressable campaigns work very well for most advertisers, many are still too shy or too uncertain to dip their toe in the water. Which, of course, is their loss – they get to watch as their competitors figure out how to use this powerful weapon.

As you might expect us to say: Jump in, the water’s fine.

Written by Michael Kubin, EVP Media